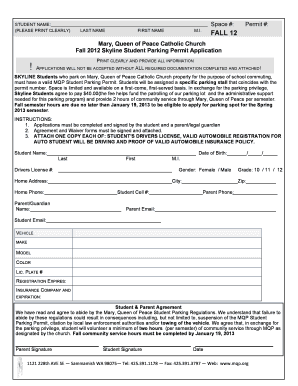

FLCS Check Register Template free printable template

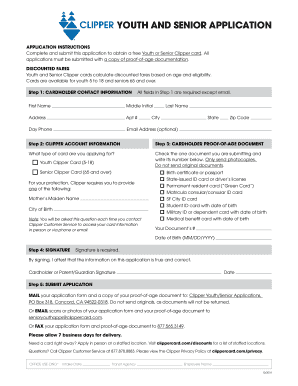

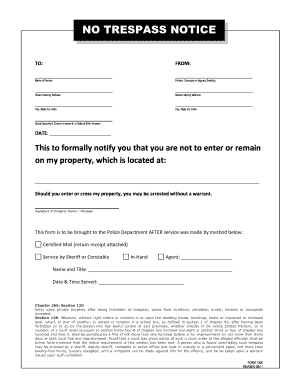

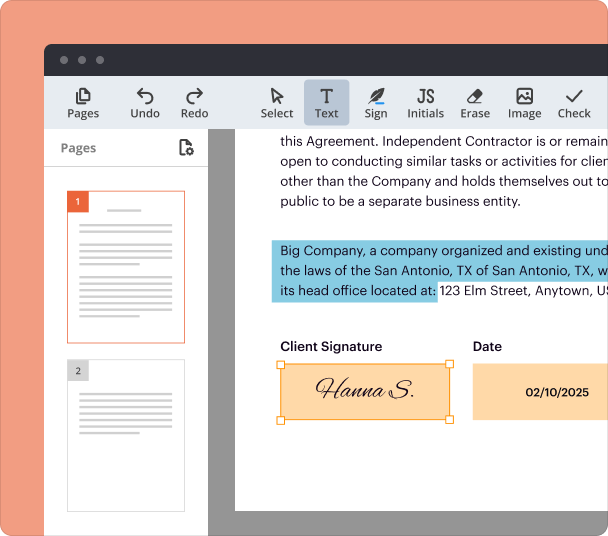

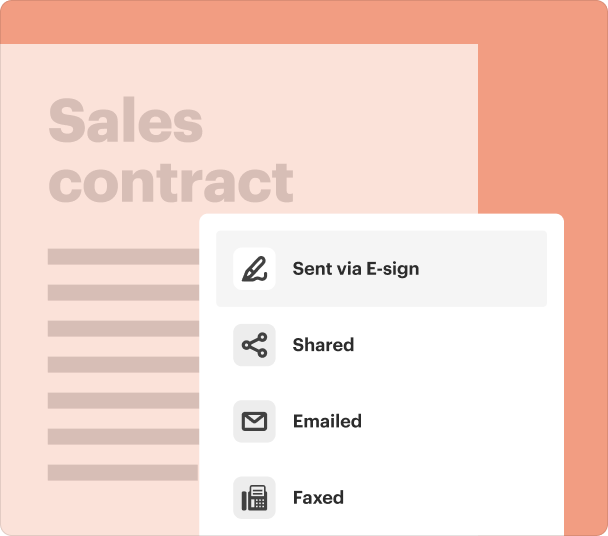

Fill out, sign, and share forms from a single PDF platform

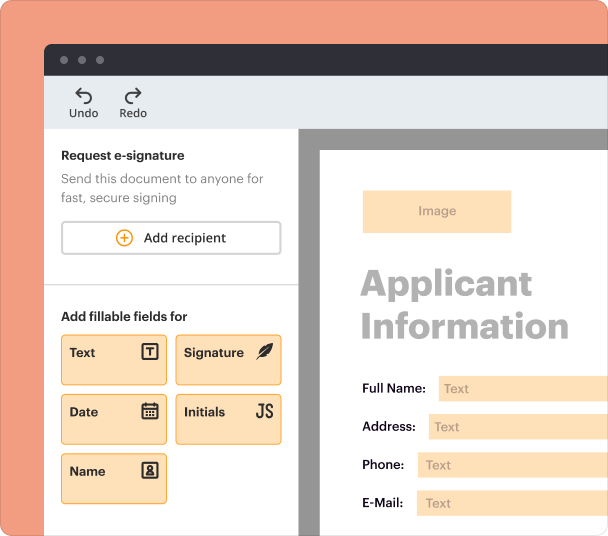

Edit and sign in one place

Create professional forms

Simplify data collection

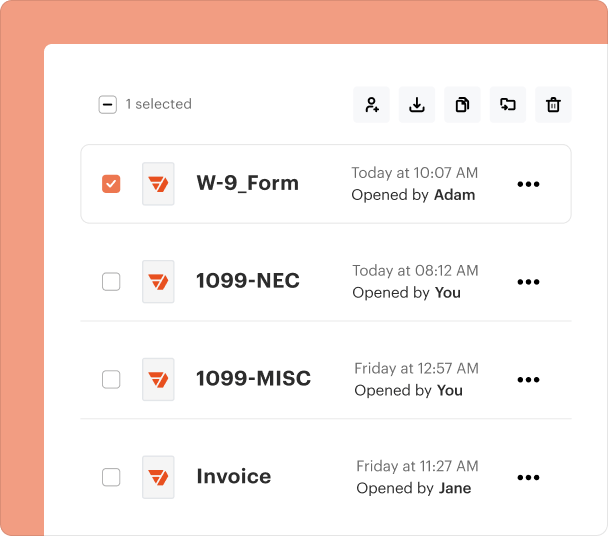

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

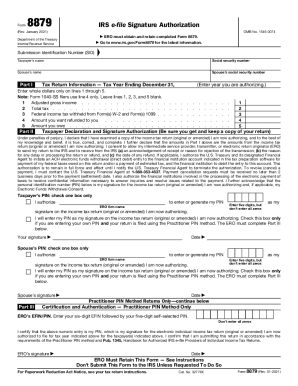

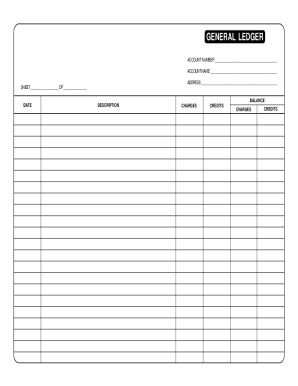

Understanding the FLCS Check Register Template Form

What is the FLCS check register template form?

The FLCS check register template form is a tool designed to help individuals and organizations track their checking account transactions efficiently. This form allows users to record details such as check numbers, transaction dates, descriptions, withdrawals, and deposits, providing a clear overview of account activity. By maintaining a check register, users can ensure accurate account balances and avoid overdrafting.

Key Features of the FLCS Check Register Template Form

The FLCS check register template includes several user-friendly features: structured rows for transaction entries, designated columns for essential information like check number, date, and transaction type. This streamlined layout promotes clarity and ease of use, making it accessible for users of all experience levels. Additionally, the template can be customized and printed for offline access, providing flexibility for users with various needs.

When to Use the FLCS Check Register Template Form

Using the FLCS check register template is particularly beneficial when managing a checking account responsibly. It is highly recommended for individuals who regularly issue checks or make electronic transactions, as it aids in tracking spending patterns and maintaining financial awareness. This form is also suitable for small businesses that need to manage multiple transactions while keeping an accurate financial record.

How to Fill the FLCS Check Register Template Form

Filling out the FLCS check register template form involves several simple steps. Start by entering the check number associated with each transaction. Next, record the date of the transaction. Proceed to describe the transaction’s purpose, followed by noting the amount withdrawn or deposited. After each entry, update the running balance to reflect the current account status. This helps in keeping a continuous record of finances without errors.

Benefits of Using the FLCS Check Register Template Form

Utilizing the FLCS check register template offers several advantages. It enhances financial organization, helping users track their spending patterns over time. By keeping a record, users can identify discrepancies, avoid overdrafts, and ensure they stay within budget. Furthermore, this tool encourages responsible financial habits, making it easier to prepare for future expenses and maintaining an awareness of financial health.

Common Errors and Troubleshooting

Common errors when using the FLCS check register template include misplacing decimal points, omitting transaction entries, and failing to update the running balance accurately. To mitigate these issues, users should double-check entries for accuracy and ensure that all transactions are recorded in a timely manner. It's advisable to regularly reconcile the register with bank statements to confirm that all entries align, thereby catching and correcting any discrepancies early.

Frequently Asked Questions about family check register form

Can I customize the FLCS check register template?

Yes, the FLCS check register template allows users to customize fields as needed, providing flexibility to accommodate individual tracking preferences.

Is the FLCS check register template suitable for business use?

Absolutely, the FLCS check register template is not only ideal for personal finance tracking but also well-suited for small business owners to manage and monitor transactions.

pdfFiller scores top ratings on review platforms